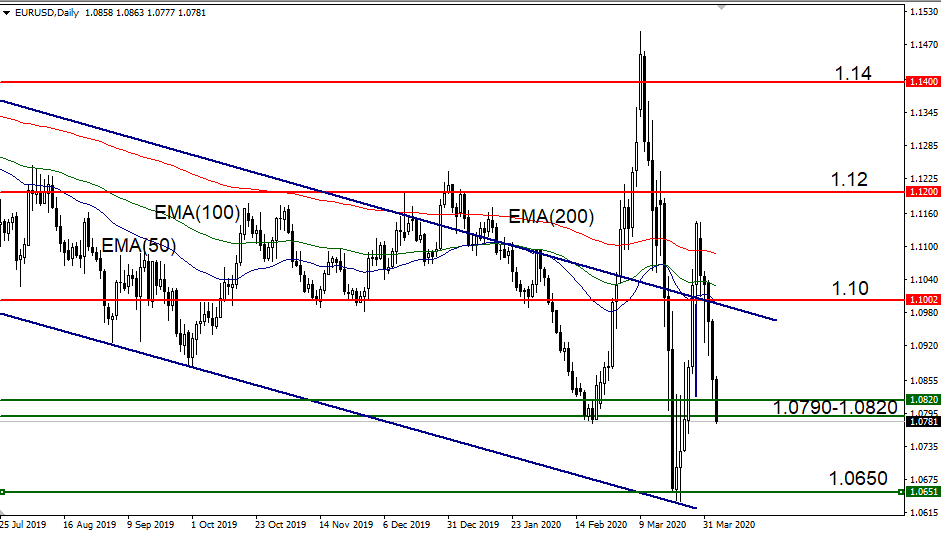

Suspended growth on the U.S. stock market (S’P500 -5% from march 31 highs), expectations of a second wave of crisis, as well as scary U.S. labor market statistics (the number of applications for unemployment benefits in the U.S. rose in the week to 28.03 million to 6.648 million from 3.3 million previously, a reduction in employment in March of 701,000 jobs) and fears of recession continue to support the global economy. eurusd decreased by 3.3% from 1.1110 to 1.0790 at the end of this week. The lack of agreement between European leaders on the issue of ‘coroners’ is also negative for the euro, depriving the euro area economy of an effective anti-crisis tool, unlike the United States, where measures to support the economy have already exceeded 10% of GDP. However, in the area of 1.0650-1.08, the item to buy EURUSD may be of interest again, provided that we see further improvements in the coronavirus situation in Italy and reasons to believe that the country withdrew from quarantine in May (baseline scenario), or a significant reduction in mortality and new infections in France and Spain. Germany’s easing and the compromise on “crown bonds” may also contribute to the recovery of the EURUSD pair by 1.10.  EURUSD (day) Trading on financial markets involves increased risk. This material is not a recommendation or offer (the purchase or sale of any assets and tools) and is made available for research purposes only.

EURUSD (day) Trading on financial markets involves increased risk. This material is not a recommendation or offer (the purchase or sale of any assets and tools) and is made available for research purposes only.

12 Oct