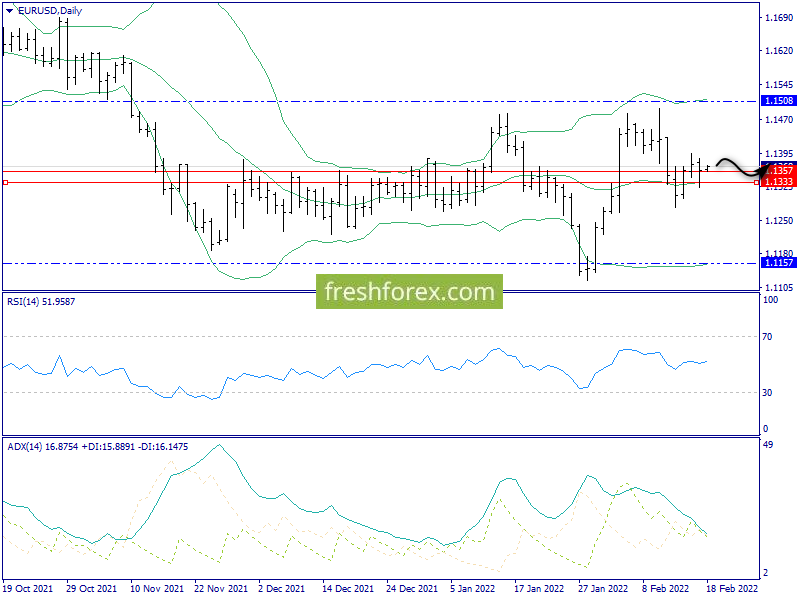

Daily chart: Changes in the last 24 hours did not follow – ADX decreases, which indicates the probable caring for the weekend in the same fled trend towards the accumulation in the region of the middle band of the Bollinger (1.1333-1.1357).

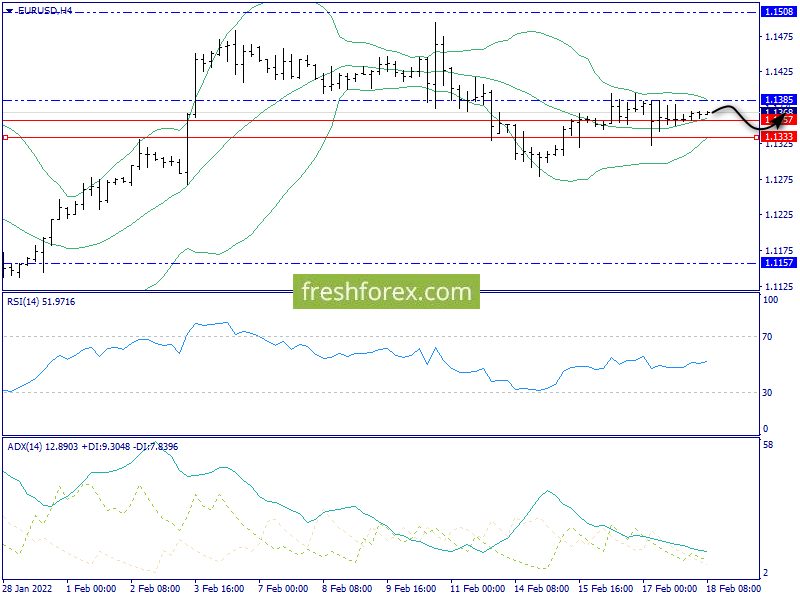

N4: Local borders of the side corridor inside envelopes (1.1333-1.1385) are quite sufficient for trading within the limits of the average volatility of the euro. ADX in an absolutely passive state.

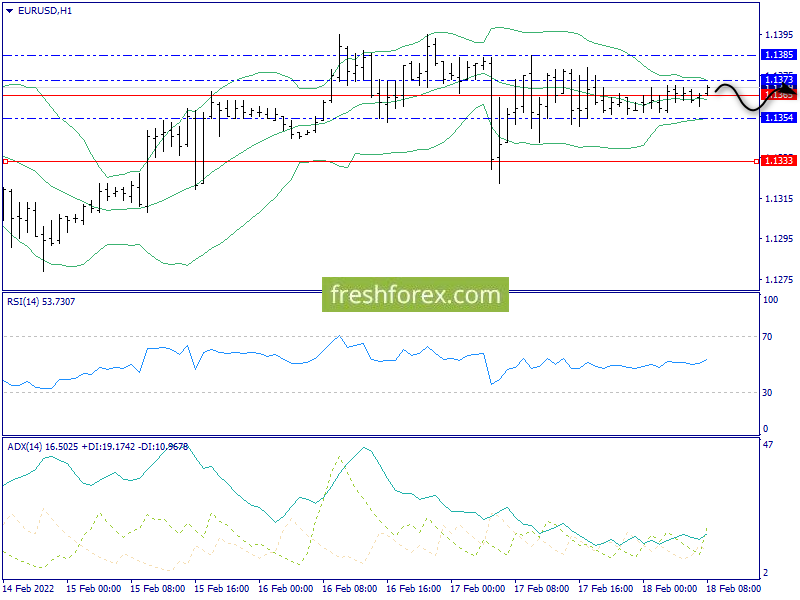

H1: Confirm the flock forecast for the day. Outdoor corridor may not exceed 20 points (1.1354-1.1373). On all timeframes there is no trend potential.

Conclusions:

Main scenario – Flet in the range 1.1354-1.1374.

Alternative scenario – wider flue corridor 1.1333-1.1385.

Trademarks: Short-term transactions in one of the proposed ranges.

In January, traders faced with an indefinite, but very volatile situation in the markets – popular stock indexes were growing, then fell in the cost, shares of the technological sector Faised, and oil moderately, but fell in price in price. At such periods it is especially important to know which tools can bring profits.

Our analysts have collected Investportfel, who will smooth the anxiety and tell you about the profidate tools of February. The expected portfolio yield can be 10%.

How to get:

1. Turn on the trading account in the amount of 90 USD to February 28, 2022

2. Send an account number that you replenished on the mail [Email Protected].