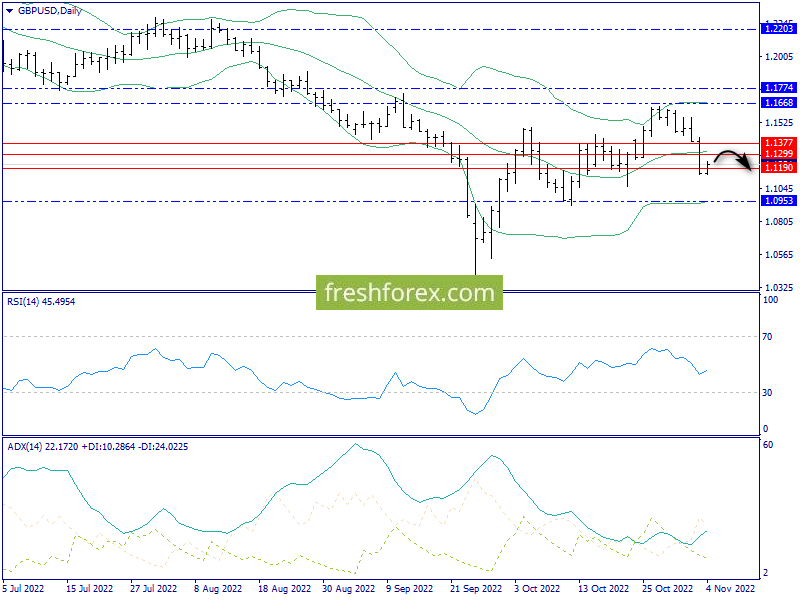

daily schedule : the couple was in the lower envelope of the Bolinger, which indicates a high probability of continuing the reduction of quotations in direction 1.0953 (lower boundary of the range). A return to the middle lane (1.1300) should be considered as a good trade opportunity.

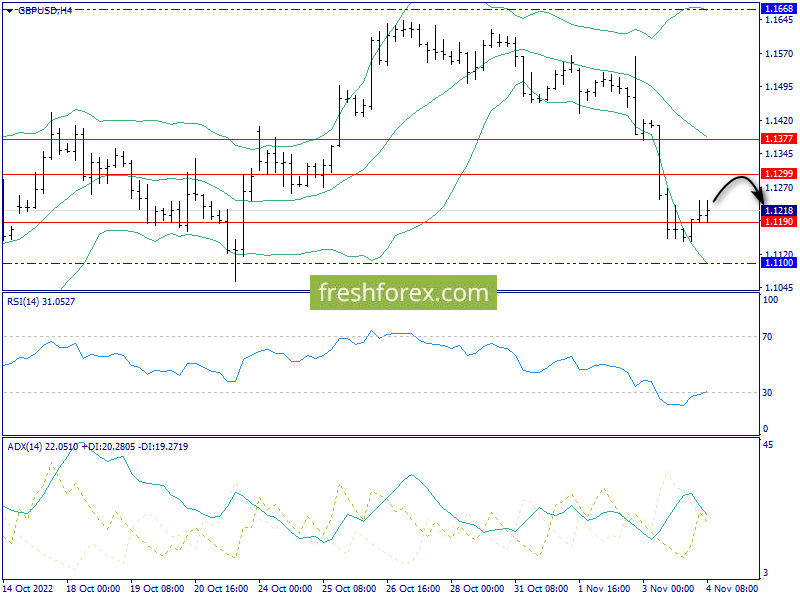

N4 : The presence of breakdown of the lower envelope of the Bolinger also indicates the advantage of sellers in the market. The optimal sales area is 1.1300-1.1377.

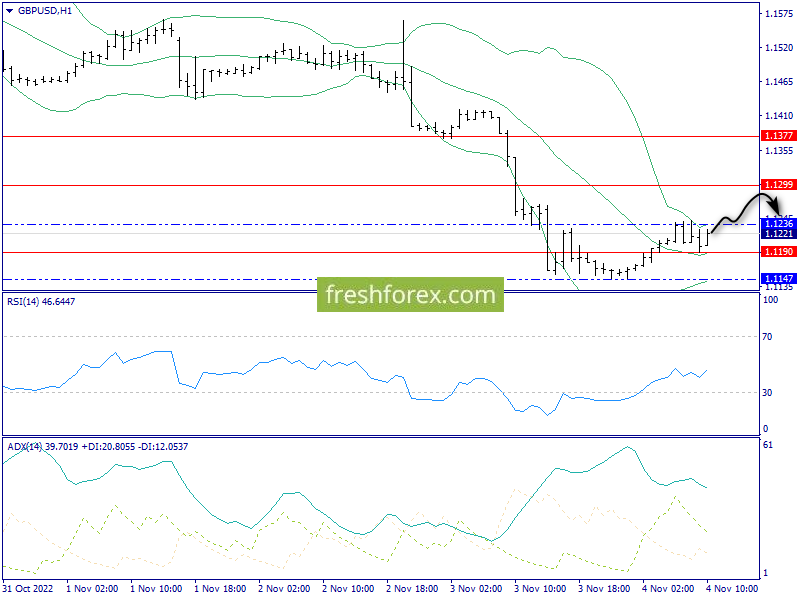

N1 : Strong intraday resistance 1.1236 (upper strip of Bolinger) It can stop growth in case of low volatility.

Conclusions :

The main scenario – growth by 1.1300, then a reap down.

Alternative scenario – Flet in the range 1.1147-1.1236.

Trade decisions :

1. Shopping by 1.1300.

2. Sales from 1.1300.